Welcome to non-profit special event season. At least that is the case where I live. Over the course of this last week, we’ve examined FOUR very special and unique special events. Today, we’ll end all of this “party talk” by discussing a few tips and tricks.

Welcome to non-profit special event season. At least that is the case where I live. Over the course of this last week, we’ve examined FOUR very special and unique special events. Today, we’ll end all of this “party talk” by discussing a few tips and tricks.

However, before we start, please read this quick disclaimer:

“If your agency is small (e.g. too few staff, too few board members, too few volunteers, too few donors, etc) and you need to raise some SERIOUS money, then STOP thinking about throwing a party to raise money! Remember, CharityNavigator.com studied the return on investment (ROI) question and found that the average non-profit will spend $1.33 (direct & indirect costs) to raise $1.00 using a special event vehicle.”

So, if this disclaimer describes your non-profit agency, then I urge you to round-up a small group of volunteers (e.g. those who REALLY believe in what you’re trying to do) and organize them into a group that asks their friends-neighbors-family for direct contributions. Yes, this approach is scary for a lot of people, but it is more effective and you’ll raise more money with less effort.

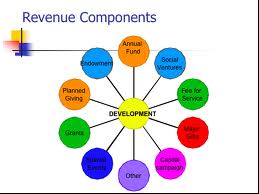

With that disclaimer out-of-the-way, the following are a few special event observations, tips and tricks for those of you who aren’t quite so desperate and might already have a comprehensive resource development program in place:

With that disclaimer out-of-the-way, the following are a few special event observations, tips and tricks for those of you who aren’t quite so desperate and might already have a comprehensive resource development program in place:

- If you look around the table and see more staff than volunteers during the planning phase, then please STOP and go recruit more volunteers. This isn’t hard. There are so many people out there who love to plan and participate in a party (at least more so than there are people dying to work pledge cards).

- Remember, special events that make crazy sums of money typically do so because of corporate sponsorship and not because a lot of people purchased tickets. Yes, you need people to attend, but make sure to focus your energy on selling sponsorships.

- Speaking of sponsorships . . . make sure there is VALUE in those sponsorship packages. Remember . . . companies give you money for different reasons than individuals. So, sit down with your corporate prospects and figure out what they value. Once you figure that out, you’ll easily be able to sell them a sponsorship or craft one around their needs (e.g. marketing impressions, employee involvement, etc). The key here is talking to them in advance AND listening to them AND giving them what they want and need.

- The first three letters in fundraising are F-U-N, and special events should personify this word. If you and your volunteers aren’t having a blast planning, organizing and running a special event, then you need to STOP and figure that out! There are so many ways to inject fun into your event: theme, contests, recognition, etc. However, it doesn’t happen accidentally. Non-profit and fundraising professionals set the stage with their demeanor, attitude, approach and ideas.

- Infuse mission into your fundraising event. Your special event is a great opportunity to “cultivate” new prospects and “steward” existing donors. This is your moment to shine and educate. Sure, playing 18 holes of golf is fun, but if you can’t find fun and ways to talk about your mission and get people excited about what you do, then I suggest not doing the event.

I don’t have unlimited space to share an infinite number of ideas with you. So, the following links are just a few additional fundraising professionals and organizations I suggest you check-out and read as you strive for creating bigger and better special events: Joanne Fritz, Convio & Event 360, and Andrew Olsen.

I don’t have unlimited space to share an infinite number of ideas with you. So, the following links are just a few additional fundraising professionals and organizations I suggest you check-out and read as you strive for creating bigger and better special events: Joanne Fritz, Convio & Event 360, and Andrew Olsen.

If your “fundraising strategy” is predicated on using special events to bring money into your agency, then you’re heading down the wrong fundraising road. Special events don’t make you much money when it is all said and done. I’m not saying “don’t throw a party;” however, I am saying “throw a party for the right reasons.” Sure, you’ll bring some cash into your bank account (not accounting for indirect costs, of course). However, special events are very effective when there is another step (or two or three) in your resource development program that you can transition your event donors (e.g. annual campaign, mail campaign, etc).

Here’t to your health!