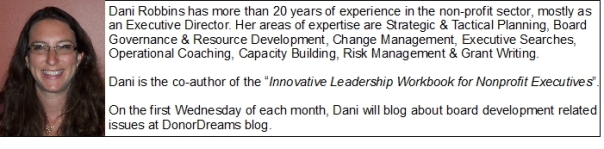

Dani Robbins is the Founder & Principal Strategist at Non Profit Evolution located in Columbus, Ohio. I’ve invited my good friend and fellow non-profit consultant to the first Wednesday of each month about board development related topics. Dani also recently co-authored a book titled “Innovative Leadership Workbook for Nonprofit Executives” that you can find on Amazon.com.

Governance: The Work of the Board, part 2

Acting as the Fiduciary Responsible Agent

By Dani Robbins

Welcome to part two of our five-part series on Governance. The first post reviewed the Board’s role in Hiring, Supporting and Evaluating the Executive. Today, let’s discuss the Board’s role as the fiduciary responsible agent, which is quite different from the fiduciary mode outlined in my favorite Board book Governance as Leadership and summarized in The Role of the Board. Fiduciary responsibility is one of the 5 pieces of the fiduciary mode, which is where governance begins for all boards and ends for too many.

Welcome to part two of our five-part series on Governance. The first post reviewed the Board’s role in Hiring, Supporting and Evaluating the Executive. Today, let’s discuss the Board’s role as the fiduciary responsible agent, which is quite different from the fiduciary mode outlined in my favorite Board book Governance as Leadership and summarized in The Role of the Board. Fiduciary responsibility is one of the 5 pieces of the fiduciary mode, which is where governance begins for all boards and ends for too many.

As previously mentioned, Boards are made up of appointed community leaders who are collectively responsible for governing an organization. That includes:

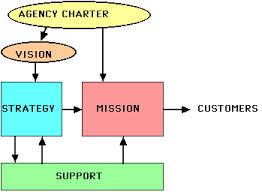

- Setting the Mission, Vision and Strategic Plan,

- Hiring, Supporting and Evaluating the Executive Director,

- Acting as the Fiduciary Responsible Agent,

- Setting Policy, and

- Raising Money.

One of my goals for this post is to rectify the common practice in the field of people telling nonprofit executives and boards how things should be done without any instruction as to what that actually means or how to accomplish it.

What it means to meet your fiduciary responsibility is:

It is the Board’s role to:

- Read, understand and approve the financials

- Review, understand and approve the audit, as appropriate

- Review and sign the 990

- Understand how the programs tie to the mission and the number of people served in those programs as well as the program’s impact

What that means is:

Financial statements should be prepared by the assigned staff or volunteer and reviewed by Finance Committee, often Chaired by the Treasurer, and then presented, by that Treasurer, to the full Board every time the full Board meets. Members of the Board should receive and review the information in advance and come to meetings prepared to ask questions and continue to ask questions until they understand and are willing to have their name listed as having approved the financials. Once questions have been answered and all members are satisfied, the financial statements should be voted upon and either approved or sent back to committee with instructions to be addressed.

Please do not vote for something you do not understand. When I do this training with Boards, I often say, the Exec will just get fired; Board members will go to jail. I’m only mostly kidding. The Exec will likely go to jail too. Either way, the community and the law will hold you as a Board member responsible.

The audit is prepared by an independent accounting firm in an effort to assess if the organization is operating in accordance with Generally Accepted Accounting Principles (GAAP) and also within their commitments. Different audits are required based on the amount of government funding that is received. The costs of such audits vary depending on the budget size, revenue streams, and also the quality of the financial systems and the need to for the auditor to clean up those systems.

The audit is prepared by an independent accounting firm in an effort to assess if the organization is operating in accordance with Generally Accepted Accounting Principles (GAAP) and also within their commitments. Different audits are required based on the amount of government funding that is received. The costs of such audits vary depending on the budget size, revenue streams, and also the quality of the financial systems and the need to for the auditor to clean up those systems.

Audits should be bid out, in conjunction with organizational policy, every few years. The auditor that is selected should conduct the audit and also come to the Board meeting to present their findings and answers any questions that Board members may have.

Auditors also prepare and should explain a management letter which includes suggestions on improvements that could be made. Such letters didn’t used to be, but are now regularly requested by funders so it is imperative the Board is aware of what’s included within and have discussed the ramifications of accepting, and also not accepting the recommendations.

Most agencies pay for an audit to be done every year; some less often but still on a specific schedule driven by policy. The audit is submitted with most grant requests, to the national office of most affiliated organizations, as applicable and is given out frequently to anyone who requests a copy. Some organizations post a copy on their website.

The firm that prepares the audit is usually also the firm that prepares the 990, which is the tax return that non profits file each year. The 990 should be reviewed by the Board, prior to being submitted, and should be signed by the Treasurer. It is often signed by the CEO, but it should be signed by the Treasurer or another member of the Executive Committee.

Finally, as part of meeting their fiduciary responsibility, the Board should understand how the programs tie to the mission, the number of people served in those programs as well as the impact of that program.

Finally, as part of meeting their fiduciary responsibility, the Board should understand how the programs tie to the mission, the number of people served in those programs as well as the impact of that program.

This does not mean the Board needs to be –- or even should be — in the weeds of programming.

It is the CEO’s responsibility to ensure the program’s creation, implementation, management and evaluation. It is the Board’s responsibility to understand how such programs are aligned with the mission and the vision of the organization, the impact of that program on the clients your serve as well as the number of people served by those programs.

Fiduciary responsibility means that the Board –- and not just the Treasurer but the whole Board — is responsible for safeguarding the community’s resources and ensuring accountability and transparency.

What’s been your experience? As always, I welcome your insight and experience.

It seems like I’ve been on the road a lot this month, and this allows me to interact with all sorts of talented and amazing non-profit professionals. In fact, just last night I was at dinner with another non-profit consultant who shared with me his “formula” for a successful board volunteer.

It seems like I’ve been on the road a lot this month, and this allows me to interact with all sorts of talented and amazing non-profit professionals. In fact, just last night I was at dinner with another non-profit consultant who shared with me his “formula” for a successful board volunteer.

Welcome to the final post in our five-part series on Governance. We have already discussed the Board’s role in

Welcome to the final post in our five-part series on Governance. We have already discussed the Board’s role in

The following is a thumbnail sketch of what my process looked like:

The following is a thumbnail sketch of what my process looked like: I am not suggesting that my process is the right way to put a non-profit budget together. However, I do believe strongly in the following few budget construction principles:

I am not suggesting that my process is the right way to put a non-profit budget together. However, I do believe strongly in the following few budget construction principles: Welcome to part four of our five part series on Governance. We have already discussed the Board’s role in

Welcome to part four of our five part series on Governance. We have already discussed the Board’s role in  Last week a dear non-profit friend of mine from California couldn’t sleep. She tossed and she turned. Ultimately, she got out of bed, turned on her computer and started talking into a microphone. When I woke up in the morning in my bed in Elgin, Illinois, there was an email sitting in my inbox with a voice file attachment. Her words have tumbled around in my head for a week, and I’ve decided to enlist your support in dissecting them.

Last week a dear non-profit friend of mine from California couldn’t sleep. She tossed and she turned. Ultimately, she got out of bed, turned on her computer and started talking into a microphone. When I woke up in the morning in my bed in Elgin, Illinois, there was an email sitting in my inbox with a voice file attachment. Her words have tumbled around in my head for a week, and I’ve decided to enlist your support in dissecting them. After listening to my friend’s recording, I started Googling around and searching for anything that anyone might have written about characteristics and traits of effective boards. I was especially intrigued by her question about incorporating personality testing into the board development process. After all, many workplaces are incorporating this type of assessment into their employee hiring process.

After listening to my friend’s recording, I started Googling around and searching for anything that anyone might have written about characteristics and traits of effective boards. I was especially intrigued by her question about incorporating personality testing into the board development process. After all, many workplaces are incorporating this type of assessment into their employee hiring process. Competencies

Competencies Welcome to part three of our five-part series on Governance. We have already discussed the Board’s role in

Welcome to part three of our five-part series on Governance. We have already discussed the Board’s role in  I recommend organizations have the following policies:

I recommend organizations have the following policies: Policies address today. Plans take you into the future.

Policies address today. Plans take you into the future.

The audit is prepared by an independent accounting firm in an effort to assess if the organization is operating in accordance with Generally Accepted Accounting Principles (GAAP) and also within their commitments. Different audits are required based on the amount of government funding that is received. The costs of such audits vary depending on the budget size, revenue streams, and also the quality of the financial systems and the need to for the auditor to clean up those systems.

The audit is prepared by an independent accounting firm in an effort to assess if the organization is operating in accordance with Generally Accepted Accounting Principles (GAAP) and also within their commitments. Different audits are required based on the amount of government funding that is received. The costs of such audits vary depending on the budget size, revenue streams, and also the quality of the financial systems and the need to for the auditor to clean up those systems. Finally, as part of meeting their fiduciary responsibility, the Board should understand how the programs tie to the mission, the number of people served in those programs as well as the impact of that program.

Finally, as part of meeting their fiduciary responsibility, the Board should understand how the programs tie to the mission, the number of people served in those programs as well as the impact of that program.

Once your hire an Executive Director, s/he needs to be supported. Supporting an Executive Director is where the rubber meets the road.

Once your hire an Executive Director, s/he needs to be supported. Supporting an Executive Director is where the rubber meets the road. When it comes to financial management, I’ve run into two types of non-profit organizations. There are those organizations who struggle with financial management and don’t have a strong and independent Finance committee in place. Then there are agencies whose Finance committee is the strongest voice in the boardroom. For the latter type of organization, the question about whether or not to form an audit committee always seems to linger in the air with a diversity of opinions spinning around it.

When it comes to financial management, I’ve run into two types of non-profit organizations. There are those organizations who struggle with financial management and don’t have a strong and independent Finance committee in place. Then there are agencies whose Finance committee is the strongest voice in the boardroom. For the latter type of organization, the question about whether or not to form an audit committee always seems to linger in the air with a diversity of opinions spinning around it. The news last week that the Justice Department will freeze grant funding for

The news last week that the Justice Department will freeze grant funding for  I believe that when money is abundant controls are less strict. Conversely, when resources are scarce . . .

I believe that when money is abundant controls are less strict. Conversely, when resources are scarce . . .