I cannot count the number of times that I’ve attended a non-profit organization’s special event fundraiser and walked away with a gift acknowledgement letter that was not compliant with “IRS Publication 1771, Charitable Contributions–Substantiation and Disclosure Requirements”.

I cannot count the number of times that I’ve attended a non-profit organization’s special event fundraiser and walked away with a gift acknowledgement letter that was not compliant with “IRS Publication 1771, Charitable Contributions–Substantiation and Disclosure Requirements”.

Rather than use the language of accountants and tax professionals to explain, I’ll let the following hypothetically example speak for itself.

- My first contribution to “Agency X” is the purchase of two dinner tickets for what I am hoping will be the best rubber chicken of my life. My out-of-pocket expenses to get in the room is $120.

- When I show up, I am assaulted by happy volunteers selling 50-50 raffle tickets. My out-of-pocket expenses to get these intensely happy people who are blocking my path to the bar is $20.

- With a nice glass of wine in my hand, I am finally able to mingle with old friends, but I end distracted by all of the shiny objects in the silent auction. <<Sigh>> At the end of the evening, I discover that “Agency X” is deeper into my wallet for another $250 in out-of-pocket expenses.

- The final blow came many glasses of wine into the evening during the live auction (ahhhh, of course it is always the booze and the live auction that sinks most donors). Those Opening Day Chicago Cubs tickets had my name written all of them and only cost $1,000.

So, the next morning usually comes with a hangover and regret (even though “Agency X” is an amazing charity and you’re always happy to have supported their awesome mission). A few days later in the mail comes a gift acknowledgement letter. It tells me how wonderful I am and contains some nice “return on investment” and stewardship verbiage. Ahhhh, gotta love that warm fuzzy feeling.

So, the next morning usually comes with a hangover and regret (even though “Agency X” is an amazing charity and you’re always happy to have supported their awesome mission). A few days later in the mail comes a gift acknowledgement letter. It tells me how wonderful I am and contains some nice “return on investment” and stewardship verbiage. Ahhhh, gotta love that warm fuzzy feeling.

You’re probably wondering “What’s wrong with all that?”

Well, the gift acknowledgement letter thanked me for my charitable contribution of $1,390.

Sure, if you do the math $120 + $20 + $250 + $1,000 does add up to $1,390, but this was not size of my “charitable contribution” according to the Internal Revenue Service, and now I need to take time out of my busy day to chase down the executive director or fundraising professional at “Agency X” for a correct letter. To help clarify the math, here is exactly what the IRS has to say on the subject:

“A donor may only take a contribution deduction to the extent that his/her contribution exceeds the fair market value of the goods or services the donor receives in return for the contribution; therefore, donors need to know the value of the goods or services.”

Let’s circle back and do the math one more time:

Let’s circle back and do the math one more time:

- The event tickets cost $120, but the food I received in exchange for the ticket purchase was valued at $20 per plate. So, $120 minus $40 means that the charitable contribution only amounted to $80.

- The $20 in raffle tickets got me four chances at a cash prize. The “value” I received for those chances was twenty bucks. So, $20 minus $20 means that I didn’t make a charitable contribution in the eyes of the IRS.

- The silent auction was a huge benefit to me because I got some amazing bargains. Woo Hoo! Move over Wal-Mart! So, I might have spent $250, but the items I won totaled $500 in value. So, $250 minus $500 means that I didn’t make a charitable contribution in the eyes of the IRS.

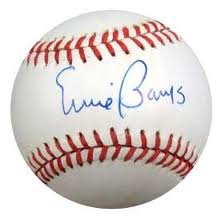

- And last but certainly not least, there was the booze fueled live auction. The bad news . . . it was $1,000. The good news . . . I finally got something to write off on my taxes. Opening Day tickets to see another woeful season of the Chicago Cubs are valued at $500 (of course, White Sox fans would argue that they are worth nothing). So, $1,000 minus $500 means that I can deduct $500 from my taxes next year.

The IRS tells us that it is legitimate to acknowledge my overall gift of $1,390 as long as somewhere (usually at the bottom of the letter in a footnote) there is language that explains that the fair market value of the items I purchased was $810 and only $580 of my $1,390 contribution is tax-deductible.

In my experience as a donor, this rarely happens and I end up wasting my time chasing after a new gift acknowledgement letter. The harm to “Agency X” is twofold:

- It is counterproductive to annoy the donor. This is not good stewardship and doesn’t help “Agency X” in its efforts to secure the next contribution from me.

- It can result in fines to “Agency X” if the IRS ever found out.

What is the potential penalty? Here is what the code says:

“A penalty is imposed on charities that do not meet the written disclosure requirement. The penalty is $10 per contribution, not to exceed $5,000 per fundraising event or mailing.”

If you want to learn more, Joanne Fritz at about.com does a nice job explaining it. You can also click here to get it directly from the IRS.

Note: “Agency X” does not exist. I am not calling out any one particular non-profit organization in my philanthropy portfolio. The aforementioned examples are a “compilation” of things I’ve purchased over the last 10 years. Please don’t add me to you special event mailing list. 🙂

Please scroll down and use the comment box below to share the “boilerplate language” that your agency uses at the bottom of its special event gift acknowledgement letters. Please trust me that 30 seconds of your time will benefit countless smaller non-profit agencies. If I had a nickel for every time I was asked for sample boilerplate language, I’d be rich! We can all learn from each other.

Here’s to your health!

Erik Anderson

Founder & President, The Healthy Non-Profit LLC

www.thehealthynonprofit.com

erik@thehealthynonprofit.com

http://twitter.com/#!/eanderson847

http://www.facebook.com/eanderson847

http://www.linkedin.com/in/erikanderson847

Not only does fully and correctly disclosing the deduction avoid issues with the IRS for the nonprofit, it is also a nice value add for the donor! The donor gets a nice deduction on their tax return, and they should also take the correct deduction on their tax return.

Thanks, John. Spoken like a true public accounting tax consultant! Please say hello to all of our friends at Grant Thornton (the best public accounting firm in the entire world). 🙂

~Erik

Erik: You outdid yourself with this post. It is spot on. Thanks for the valuable resource. I am going to email this to all my fav non-profits!

Thanks, Patricia! You are too kind. If you have any good examples of letters or language, please circle back and post it as a comment for others to see. I know that you’re a super fundraising professional with a great track record. Anything you can share with my readers would be appreciated.

I hope all is going well for you!

~Erik

Your explaination is fantastic! I’m passing this along to some of my PTA friends. Thanks Eric!

Thanks, Jim. As it relates to PTA fundraisers, you might want to also make sure that the organization is a registered 501c3 nonprofit organization. Otherwise, the tax deductibility of a gift to the PTA gets more complicated and might not be a deduction.

~Erik

Yes, we are a registered 501c3. By definition, any PTA in Illinois should be a current/registered 501c3, but PTO organizations are a whole different story as they have much less oversight. We just finished helping at an auction that raised 20K for scholarships. I got sick of correcting the people who were saying that “everything” (tickets, drinks, raffles, etc.) was tax deductable, so I’m just passing along your explaination. Thanks again Eric!

Ah, that makes a lot of sense. Thanks for circling back with that explanation. I hope all is well and I hope the blog post helps you shine some light on some confusing IRS stuff for your PTA members. 🙂

~Erik

What???!! You have opening day Cubs tickets??????? Ugh! Pales in comparison to my opening day Angels tickets….even if the Angels are seemingly going to punish most every team this year…..oh, wait, back to business —

Yes, this is an issue everywhere…seems like we are explaining it every event we do. Thanks for the refresher

Hello, we have a 501C3, and I am so glad that we have come across your website! We are new at larger contributions and want to do things right.

We have learned much from your site. For everyone out there….check with the IRS rules and sites like this that make it so simple and uncomplicated.

Thank you again for your help!

debra

Hello Debra! First, let me congratulate you on your 501c3. Next let me commend you on deciding that sustainability of your organization is rooted in philanthropy and inviting others to support your mission. Finally, let me thank you for finding my blog, reading some of what I have to say and weighing in with a comment. I hope we see much more of you in the coming weeks. Thanks!

~Erik

So obviously a pleasant, local, casual restaurant with a back-room for events and an elegant 4-star restaurant playing host to a gala dinner are not going to be comparable when calculating the FMV. I’m guessing that the basic per head food cost – for catering, or prix-fixe cost if it’s a restaurant open to the public (discounting any additional costs for staff, linens, flowers, coat check etc. etc. – which would normally be “house” costs) would be a reasonable amount to use for the FMV? Because it’s just as unreasonable to deduct LeBernardin prices for a fundraiser at McDonalds as it is to deduct McDonalds prices for a gala at LeBernardin. Or am I missing something?