When it comes to financial management, I’ve run into two types of non-profit organizations. There are those organizations who struggle with financial management and don’t have a strong and independent Finance committee in place. Then there are agencies whose Finance committee is the strongest voice in the boardroom. For the latter type of organization, the question about whether or not to form an audit committee always seems to linger in the air with a diversity of opinions spinning around it.

When it comes to financial management, I’ve run into two types of non-profit organizations. There are those organizations who struggle with financial management and don’t have a strong and independent Finance committee in place. Then there are agencies whose Finance committee is the strongest voice in the boardroom. For the latter type of organization, the question about whether or not to form an audit committee always seems to linger in the air with a diversity of opinions spinning around it.

In my experience, strong finance committees have had a difficult time accepting the case for support for forming another standing committee focused on finance. After all, it is hard to argue with the “Why fix something that isn’t broken?” argument. Moreover, the “Our agency should stay ahead of Sarbanes-Oxley legislation” also seems to fall flat.

I fought these battles a decade ago when I was on the front line leading a local non-profit organization. I was successful in my quest to form an audit committee, and it allowed us to relieve the Finance Committee of the following roles and responsibilities:

- Selecting the audit and periodically putting the audit work out for bid.

- Reviewing the work of the auditor and making recommendations to the board based on this work.

- Providing board oversight of the auditor so that management hasn’t his/her only point of contact.

- Review and assessment of the agencies internal controls.

In hindsight, I loved this move for two big reasons:

- It got some stuff off of the Finance Committee’s plate and allowed them to focus on important stuff.

- It gave me another committee opportunity to engage board volunteers and recruit influential finance-minded non-board volunteers.

I must admit that in the beginning many people (including myself) still had a difficult time with the blurry line between these two committees. This issue recently reared its head at an agency where I am doing some work, and I really like the clarity that came out of the conversation. So, I thought I’d share it with you this morning.

- Finance Committee – develops and monitors financial practice

- Audit Committee – monitors the process in which financial practices are carried out

Are you still not feeling it? OK, the following is a list of resources that I really like and hopefully provide you with the answers for which you’re looking:

- Minnesota Council of Nonprofits: “Nonprofit Finance vs Audit Committees“

- BDO’s Nonprofit Standard blog: “Effective Audit Committees“

- The Center for Association Leadership: “Nonprofit Audit Committees — A Toolkit“

- American Institute of CPAs: “AICPA Not-for-Profit Audit Committee Toolkit Downloads“

- Virginia Society of Certified Public Accountants: “Audit Guide for Audit Committees of Small Nonprofit Organizations“

I hope you find these links helpful.

Has your organization formed an audit committee? What was your experience? Did you develop two different committee charters with two different committee work plans? If so, how did you divide things up? How have things worked since you made the change? Does your audit committee feel like a superficial after-thought that you only did because people were telling you it was a best practice?

Please scroll down and share your thoughts and experiences in the comment box below. This is an important board governance question that always seems to fly under the radar. Let’s talk about it.

Here’s to your health!

Erik Anderson

Founder & President, The Healthy Non-Profit LLC

www.thehealthynonprofit.com

erik@thehealthynonprofit.com

http://twitter.com/#!/eanderson847

http://www.facebook.com/eanderson847

http://www.linkedin.com/in/erikanderson847

These five bullet points are just the tip of the iceberg. The fact of the matter is that we started planning next year’s Duck Race in the immediate days and weeks after wrapping one up. This special event raffle was a year-round affair.

These five bullet points are just the tip of the iceberg. The fact of the matter is that we started planning next year’s Duck Race in the immediate days and weeks after wrapping one up. This special event raffle was a year-round affair. Welcome to O.D. Fridays at DonorDreams blog. Every Friday for the foreseeable future we will be looking at posts from John Greco’s blog called “

Welcome to O.D. Fridays at DonorDreams blog. Every Friday for the foreseeable future we will be looking at posts from John Greco’s blog called “ As time passes, the waves of change crash against your seemingly rock solid organizational exterior, but change is slowly occurring. Here are just a few examples:

As time passes, the waves of change crash against your seemingly rock solid organizational exterior, but change is slowly occurring. Here are just a few examples:

For example, I concluded that I would want the super human ability to “read people’s minds“. As I started thinking about why I might want that superpower, I concluded that knowing what a donor wants and how they want it would make me one of the best fundraising people on the planet.

For example, I concluded that I would want the super human ability to “read people’s minds“. As I started thinking about why I might want that superpower, I concluded that knowing what a donor wants and how they want it would make me one of the best fundraising people on the planet.

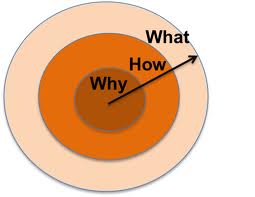

Those organizations that excel at strategic planning have a very clear understanding of what they do, how they do it, and why they exist. However, those organizations that are little fuzzy on these ideas do a lot of wrestling with themselves. Sometimes countless hours are spent at the 50,000 foot view talking about these issues . . . and for good reason! Without clarity on What-How-Why, there is no way you can set goals, develop objectives and write action plans that are meaningful in any way, shape or form.

Those organizations that excel at strategic planning have a very clear understanding of what they do, how they do it, and why they exist. However, those organizations that are little fuzzy on these ideas do a lot of wrestling with themselves. Sometimes countless hours are spent at the 50,000 foot view talking about these issues . . . and for good reason! Without clarity on What-How-Why, there is no way you can set goals, develop objectives and write action plans that are meaningful in any way, shape or form. When I used to work at Boys & Girls Clubs of America (BGCA), my colleagues were responsible for the existence of something called theFUNDRAI$INGbank, which is a special webpage embedded inside of the intranet accessible to local affiliates. We outsourced maintenance of this page to FundRaisingInfo.com. There were many different resources located on “The Bank” including a free service called “Ask The Expert“.

When I used to work at Boys & Girls Clubs of America (BGCA), my colleagues were responsible for the existence of something called theFUNDRAI$INGbank, which is a special webpage embedded inside of the intranet accessible to local affiliates. We outsourced maintenance of this page to FundRaisingInfo.com. There were many different resources located on “The Bank” including a free service called “Ask The Expert“.

September 15, 2008 . . . do you remember where you were and what you were doing? It was the day the world changed. It was what some people have called an “economic 9-11″. Regardless of how you characterize the day that Lehman Brothers filed for bankruptcy and the stock market started its crash, it is hard to argue the following: 1) the economic paradigm we all used to live in shifted and 2) nothing will ever be the same again.

September 15, 2008 . . . do you remember where you were and what you were doing? It was the day the world changed. It was what some people have called an “economic 9-11″. Regardless of how you characterize the day that Lehman Brothers filed for bankruptcy and the stock market started its crash, it is hard to argue the following: 1) the economic paradigm we all used to live in shifted and 2) nothing will ever be the same again. Mentally take a look around your board room and see if you can identify how many Dorothy-like volunteers occupy chairs. They are kind folks (dare I say friends) who look and sound like the following:

Mentally take a look around your board room and see if you can identify how many Dorothy-like volunteers occupy chairs. They are kind folks (dare I say friends) who look and sound like the following: Don’t get me wrong. I am not suggesting a “witch hunt” to root out these folks and fire them. Dorothy serves an important role on your board. She is that cautious voice that keeps you from getting into trouble. She will stop you from pulling the plug on your annual campaign and direct mail appeals and “going all in” on ePhilanthropy efforts. Valuable? YES! However, what happens when you have too many Dorothy-like board members? Or what if you have those well-intentioned people serving in the wrong roles (e.g. board president, annual campaign chair, strategic planning committee, etc)?

Don’t get me wrong. I am not suggesting a “witch hunt” to root out these folks and fire them. Dorothy serves an important role on your board. She is that cautious voice that keeps you from getting into trouble. She will stop you from pulling the plug on your annual campaign and direct mail appeals and “going all in” on ePhilanthropy efforts. Valuable? YES! However, what happens when you have too many Dorothy-like board members? Or what if you have those well-intentioned people serving in the wrong roles (e.g. board president, annual campaign chair, strategic planning committee, etc)? There are 9-keys to “inspiring and managing yours board for fundraising success”. In fact, the reality is that these 9-keys are the same nine things you need to do to “engage” anyone in anything. However, I believe that these nine concepts are not all equal. While all are important, I have come to realize that the most important and most difficult engagement tool was best summed up by the “Wizard of Oz’s” Tim Man in this

There are 9-keys to “inspiring and managing yours board for fundraising success”. In fact, the reality is that these 9-keys are the same nine things you need to do to “engage” anyone in anything. However, I believe that these nine concepts are not all equal. While all are important, I have come to realize that the most important and most difficult engagement tool was best summed up by the “Wizard of Oz’s” Tim Man in this  As a new business owner who just opened up a nonprofit & fundraising consulting practice, I’ve made it my business to “get around”. In addition to visiting with many of my oldest and dearest non-profit friends in Elgin, Illinois, I recently attended a regional Boys & Girls Club conference and engaged countless staff and board volunteers from around the country through a very aggressive social media strategy including Twitter, Facebook, LinkedIn and this blog. While I don’t want to exaggerate, I was surprised at how many conversations looked and sounded like this

As a new business owner who just opened up a nonprofit & fundraising consulting practice, I’ve made it my business to “get around”. In addition to visiting with many of my oldest and dearest non-profit friends in Elgin, Illinois, I recently attended a regional Boys & Girls Club conference and engaged countless staff and board volunteers from around the country through a very aggressive social media strategy including Twitter, Facebook, LinkedIn and this blog. While I don’t want to exaggerate, I was surprised at how many conversations looked and sounded like this So, last week was an amazing week for my blog. It appears that I struck upon a topic of interest for the non-profit community when I focused on special events and how some agencies make poor decisions around return on investment (ROI) decisions and volunteer utilization. While I promised myself that I would end that discussion thread about zombies, I decided this morning over coffee to continue down “the yellow brick road” a little further by changing metaphors. It is Halloween season after all. LOL

So, last week was an amazing week for my blog. It appears that I struck upon a topic of interest for the non-profit community when I focused on special events and how some agencies make poor decisions around return on investment (ROI) decisions and volunteer utilization. While I promised myself that I would end that discussion thread about zombies, I decided this morning over coffee to continue down “the yellow brick road” a little further by changing metaphors. It is Halloween season after all. LOL