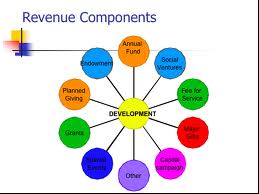

On Tuesday, I blogged about the idea of non-profit organizations looking in some non-traditional places to generate revenue such as “selling things” through unrelated business income efforts. Of course, I see non-profits also looking at “related” business income opportunities. Today, I’m turning my attention from external opportunities to “sell stuff” (e.g. thrift stores, eBay, amazon.com, etc) in an effort to create revenue streams and looking inward at internal opportunities to sell your services by charging fees.

On Tuesday, I blogged about the idea of non-profit organizations looking in some non-traditional places to generate revenue such as “selling things” through unrelated business income efforts. Of course, I see non-profits also looking at “related” business income opportunities. Today, I’m turning my attention from external opportunities to “sell stuff” (e.g. thrift stores, eBay, amazon.com, etc) in an effort to create revenue streams and looking inward at internal opportunities to sell your services by charging fees.

It would be too easy for me to take the position that instituting fees to sell your non-profit services to your clients amounts to nothing more than selling your soul. However, as we discovered in Tuesday’s post titled “Should the new non-profit mantra be: Sell! Sell! Sell!” many non-profits are generating a lot of revenue from fees for service — 45 percent of the approximate $1.5 trillion in non-profit revenue comes from  fees and services.

fees and services.

I think my blogger friend, Joanne Fritz of about.com, got it right in her post titled “Can a Nonprofit Charge Fees for Its Services?” when she suggested there is a “smell test” that needs to be passed before a non-profit should ask its clients to pay fees for the services it offers. Let’s have some fun with this smell test idea:

- <<sniff>> I don’t think domestic violence victims should be asked to pay for a place to spend the night safe from their abuser.

- <<sniff>> It seems reasonable to ask students at publicly subsidized universities to pay some tuition.

- <<sniff>> It don’t think hungry people should be asked to pay for the food they’re given at a food bank.

- <<sniff>> It seems reasonable to ask patients at a non-profit hospital to pay for care and medical attention

Well, that was easy wasn’t it? Hmmmmmm . . . not so fast! The reality is that this issue can put your agency on the proverbial “slippery slope”. Let’s take a closer look:

Well, that was easy wasn’t it? Hmmmmmm . . . not so fast! The reality is that this issue can put your agency on the proverbial “slippery slope”. Let’s take a closer look:

- Why should YMCA’s be able to charge fees to access their fitness programs? Doesn’t their non-profit tax-exempt status give them an unfair competitive advantage over for-profit companies doing the exact same thing? If you ask Bally’s Total Fitness and the fitness center industry, they’d likely say YES . . . the trail of lawsuits throughout the years would seem to support this assertion.

- Why should public universities continue to charge more and more for a college education when they can also fundraise and access other funding streams that for-profit institutions of higher education can’t touch? Doesn’t their non-profit tax-exempt status give them an unfair competitive advantage?

In this “New Normal” economic environment, I do think non-profit professionals are eyeing opportunities to “sell stuff” to enhance their revenue streams. However, discretion is the better part of valor when it comes to giving in to this emerging trend because it is one thing to look at the for-profit marketplace to sell stuff, but it can be a completely different issue when you start selling your services (and your soul).

Take the Boys & Girls Club movement as a great example. It is the mission of Boys & Girls Clubs to help “those kids who need us most,” which in most cases translates into providing services to kids from “economically disadvantaged circumstances”. There are a number of Clubs doing the math on charging fees for their services.

While it is true that Clubs have charged membership fees for more than a century, it has always been nominal . . . $1.00, $5.00, $25.00 . . . for a one year membership to the Club. This was done to create a “sense of ownership” because the value associated with something given away for free is NOTHING.

While it is true that Clubs have charged membership fees for more than a century, it has always been nominal . . . $1.00, $5.00, $25.00 . . . for a one year membership to the Club. This was done to create a “sense of ownership” because the value associated with something given away for free is NOTHING.

However, what happens to this organization’s soul when fees go from being a program tool to a revenue stream . . . $50.00, $100.00, $250.00, $500.00 per year? At what point are you soulless? At what point do your clients walk away? At what point does your mission collapse under the weight of fee for service”? At what point does the IRS enter the picture and revoke your non-profit status?

I’m not suggesting that fee for service isn’t an acceptable model for some non-profit organizations. What I am suggesting is that passing the smell test is more difficult than you may think, and it requires serious board room consideration.

So, here are a few questions I recommend board members ask themselves:

- Are there for-profit corporations in your community providing similar services? If so, then why should you have a competitive tax advantage over them?

- If your fees for comparable services are similar to other for-profit competitors, what differentiates you and makes you special enough to have a tax advantage?

- What is stopping you (and I mean really stopping you) from doing a better job with more traditional revenue streams that are unique remedies to non-profit corporations (e.g. fundraising, foundation grant writing, and various other philanthropic opportunities)?

- What will your donors think? And at what point will fees damage your philanthropic business model? (e.g. donors balking at giving you a charitable gift because they think you can just hike fees or go sell some more stuff)

So, before you leap I suggest you look. You might not have a revenue problem that needs to be fixed with a fee for service solution. You may have a human resources and staffing issue. You may have board development or volunteer issue. Of course, you may have a revenue model issue that needs to be tweaked with the addition of some fees for service.

Here is some unsolicited advice . . . If you want to “sell stuff” to generate revenue, it is far safer to open a store and weave your mission throughout its operation (e.g. Wednesday’s blog post about thrift stores or Thursday’s post about eBay and Amazon.com) than it is to look internally at selling your services and raising revenue on the backs of those you serve.

What is the going price for a soul today? I think is it PRICELESS.

Here’s to your health!

Erik Anderson

Founder & President, The Healthy Non-Profit LLC

www.thehealthynonprofit.com

erik@thehealthynonprofit.com

http://twitter.com/#!/eanderson847

http://www.facebook.com/eanderson847

http://www.linkedin.com/in/erikanderson847